Will Medicare Cover My Breast Reduction?

Breast reduction, medically known as reduction mammoplasty, is a surgical procedure that removes excess breast tissue and skin to achieve a breast size more proportionate to your body. Dr Mark Kohout, Plastic Surgeon in Sydney, explains how the procedure not only reduces the volume of your breasts but also lifts and alters their shape, potentially alleviating physical discomfort. When considering breast reduction surgery, it’s important to understand the financial aspects, particularly when it comes to Medicare coverage.

Breast Reduction: Is It Right for You?

Women consider breast reduction for various reasons. You might be experiencing chronic back, neck, or shoulder pain due to the weight of your breasts. Perhaps you’re struggling with skin irritation or rashes under your breasts, or finding it challenging to participate in physical activities. Whatever your reason, it’s essential to understand that breast reduction can be more than just a cosmetic procedure-it can also impact your physical health.

Can Your Breast Reduction Be Covered by Medicare?

Medicare is the country’s universal government health insurance scheme, providing access to a wide range of health services either free of charge or at a reduced cost. It’s designed to help all Australians access essential medical care.

However, when it comes to procedures like breast reduction, Medicare makes a crucial distinction between cosmetic and medically necessary procedures.

Cosmetic procedures, performed primarily to alter the appearance without addressing a medical issue, are generally not covered by Medicare. On the other hand, medically necessary procedures-those deemed essential for your health and well-being-may be eligible for Medicare benefits.

This distinction is particularly important in the context of breast reduction. While some may seek the procedure purely for aesthetic reasons, many seek breast reduction to alleviate physical symptoms or address medical conditions. It’s this latter category that may qualify for Medicare coverage.

Medical Necessity - When Breast Reduction Becomes More Than Cosmetic

To be considered for Medicare coverage, your breast reduction must be deemed medically necessary. This means that you’re experiencing significant health issues directly related to the size of your breasts. Some of the conditions that may necessitate breast reduction include:

- Chronic back, neck, or shoulder pain

- Skin irritation or recurrent infections under the breasts

- Nerve pain or numbness due to excessive breast weight

- Skeletal deformities caused by breast size

- Breathing problems or sleep apnoea related to breast size

- Severe distress directly linked to breast size

These health issues align with Medicare criteria for coverage. Medicare recognises that in these cases, breast reduction is not just a cosmetic procedure but a necessary intervention to increase health and quality of life.

Medicare Item Numbers for Breast Reduction Surgery

This item covers reduction mammaplasty (unilateral) with surgical repositioning of the nipple. It is specifically for cases involving breast cancer or developmental abnormality of the breast.

- The procedure is not associated with services covered by items 31512, 31513, or 31514 on the same side

- It falls under Category 3 – THERAPEUTIC PROCEDURES, Group T8 – Surgical Operations, Subgroup 13 – Plastic And Reconstructive Surgery

- The schedule fee is $1,025.80, with a 75% benefit of $769.35

- This item requires both anaesthesia and assistance

- The Multiple Operation Rule applies to this item

This item covers reduction mammaplasty (bilateral) with surgical repositioning of the nipple. It is specifically for patients with macromastia who are experiencing pain in the neck or shoulder region.

- The procedure does not involve the insertion of any prosthesis

- Like item 45520, it is not associated with services covered by items 31512, 31513, or 31514

- It falls under the same category, group, and subgroup as item 45520

- The schedule fee is higher at $1,538.80, with a 75% benefit of $1,154.10

- This item also requires both anaesthesia and assistance

- The Multiple Operation Rule applies to this item as well

Medicare Application Process

If you believe you might qualify for Medicare coverage for your breast reduction, here’s a step-by-step guide to tick all the boxes:

- Consult your general practitioner (GP): Your journey begins with your GP. Discuss your symptoms and concerns, and ask for a referral to see Dr Mark Kohout.

- See Dr Kohout: During this consultation, Dr Kohout will assess your condition and determine if you meet the criteria for a medically necessary breast reduction. This may include:

- Medical history detailing your symptoms

- Physical examination findings

- Photographs (if appropriate)

- Results of any relevant tests or imaging studies

- Schedule your surgery: If Dr Kohout finds that you do meet the criteria for Breast Reduction, you can proceed to schedule your surgery.

Once your surgery is scheduled, it’s important to start preparing physically and logistically. Learn more in our guide on Preparing for Breast Reduction Surgery.

Out-of-Pocket Costs

Even with Medicare coverage, it’s important to understand that you will still have out-of-pocket expenses. Medicare typically covers 75% of the scheduled fee for out-of-hospital services. The remaining 25% is known as the “gap” and is your responsibility. The scheduled fee referred to here, is what would be charged in a Public Hospital, after waiting many years on a Public List. You also have no say over who the performs your procedure. Private fees are typically more expensive as the surgery is performed by the surgeon of your choice, at a time of your choice and in a hospital/clinic of your choice.

Additionally, there will be other costs associated with your breast reduction that aren’t covered by Medicare. These could include:

- Anaesthetist fees

- Hospital or day surgery fees

- Post-operative garments

- Pain medications

- Follow-up appointments

It’s important to discuss all potential costs with your surgeon before proceeding with the surgery. Your surgeon should be able to provide you with a detailed quote, including Medicare rebates and out-of-pocket expenses.

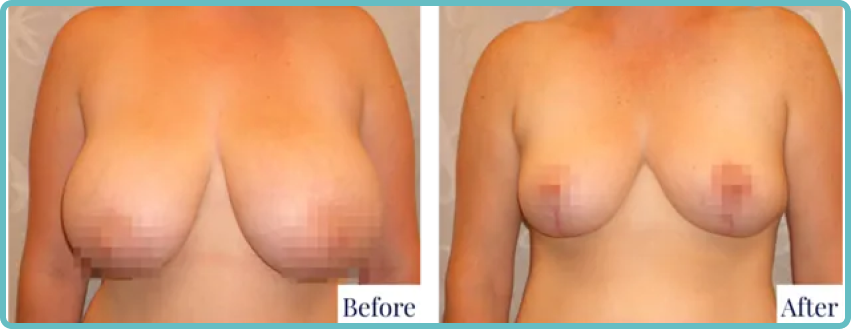

Breast Reduction Before and After Images

Private Health Insurance - A Complementary Option

While Medicare can provide some coverage for medically necessary breast reductions, private health insurance can offer additional help. If you have private health insurance, it may cover some of the costs not included in the Medicare benefit, such as hospital fees or the gap payment.

The interaction between Medicare and private health insurance can be complex. In general, Medicare will cover 75% of the scheduled fee for the surgeon’s services, while your private insurance may cover the hospital costs and potentially some or all of the gap payment.

Having private health insurance might also give you more choice in terms of your surgeon and hospital, and could result in shorter waiting times for your procedure.

However, it’s important to check with your insurance provider about their specific policies regarding breast reduction. Some policies may have waiting periods or specific conditions that need to be met before they will cover the procedure.

Other Payment Options

If your breast reduction is not deemed medically necessary and therefore not covered by Medicare, or if you’re facing significant out-of-pocket costs, there are other payment options to consider:

- Payment plans: These payment plans allow you to spread the cost of your procedure over time.

- Medical loans: Some financial institutions offer specific loans for medical procedures.

- Superannuation early release: In some cases of severe medical need, you may be able to access your superannuation early to pay for medical treatments.

- Savings: While it may take longer, saving up for your procedure can help you avoid debt.

Remember, it’s essential to fully understand the terms of any financial agreement before committing to it.

Your Next Steps

If you’re considering breast reduction and wondering whether you might qualify for Medicare coverage, here are your next steps:

- Self-assessment: Reflect on your symptoms and how they’re affecting your daily life. Are you experiencing significant physical discomfort or limitations due to your breast size?

- Consult your GP: Book an appointment with your general practitioner to discuss your concerns. They can provide an initial assessment and refer you to a plastic surgeon if appropriate.

- Research: Look into qualified plastic surgeons in your area who have experience with breast reduction procedures.

- Book a consultation: Once you have a referral, book a consultation with a plastic surgeon. This is your opportunity to discuss your goals, ask questions, and get a professional opinion on whether you might qualify for Medicare coverage.

- Gather documentation: Start collecting any relevant medical records, including documentation of treatments you’ve tried for breast-related symptoms.

Remember, every person’s situation is unique, and what applies to one individual may not apply to another. The information provided here is a general guide, but the best way to get personalised advice is through a consultation with Dr Mark Kohout.

Further Reading about Breast Reduction with Sydney Specialist Plastic Surgeon Dr Mark Kohout

- Read Dr Mark Kohout’s Procedure Page on Breast Reduction

- Read Dr Mark Kohout’s Procedure Page on Breast Surgery Procedures

Medical References for Medicare and Breast Reduction

- Will Medicare Cover My Plastic Surgery Procedure?

- Breast Reduction Surgery: An Overview

- Breast Reduction Procedure Steps

- Does breast reduction surgery increase health-related quality of life? A prospective cohort study in Australian women

- The effectiveness of surgical and nonsurgical interventions in relieving the symptoms of macromastia

Related Blog Posts

Recovery After Breast Augmentation Surgery

Healing and Recovery After Breast Augmentation: Timeline and Tips Dr Mark Kohout is a well regarded plastic surgeon with extensive experience in breast augmentation and a deep understanding of the human…

Why You Need to Stop Smoking…

Why It Is Important to Stop Smoking Before Your Plastic Surgery Procedures If you are considering plastic surgery, there’s several important steps you need to take to optimise not only…

Healing After Abdominoplasty: Key Steps for…

Recovery after abdominoplasty is a critical phase that significantly influences the final results of your surgery. Abdominoplasty, commonly referred to as a tummy tuck, is a cosmetic procedure designed to alter the abdomen’s…

Experienced Plastic Surgeon

Dr. Mark Kohout

A qualified plastic surgeon who operates with care and integrity, based in central Sydney with over 20 years of experience in the cosmetic field. His extensive training and experience assures patients they are in highly trained surgical hands. Dr. Kohout is a dedicated, friendly professional who is committed to providing the high quality care, support and results, alongside his compassionate team.

Dr Mark Kohout (MED0001133000)

Specialist Plastic Surgeon

Specialist registration in Surgery – Plastic Surgery